Member Center

Access Your Money

Debit Card

If

you opened a checking

account and opted to receive

a card, one will arrive in

about 7 business days.

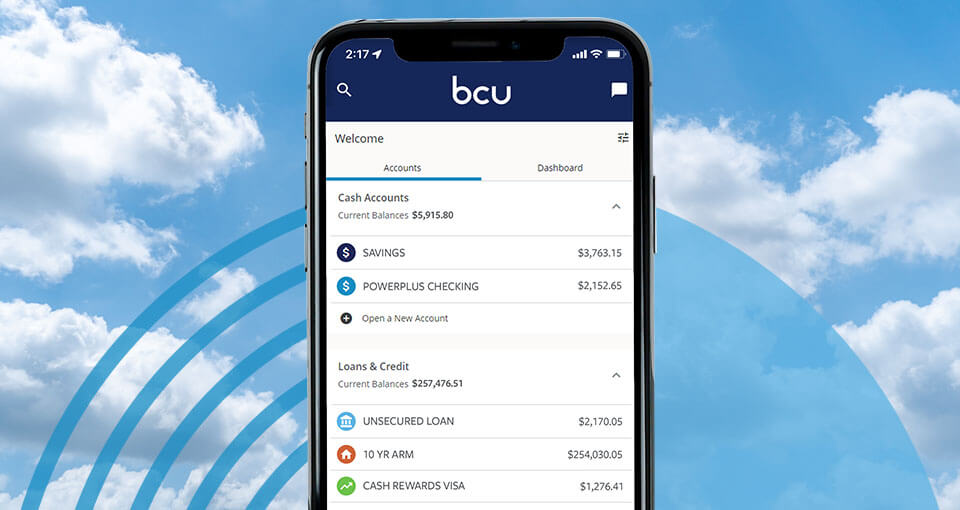

Digital Banking

Sign

up for Digital Banking to

securely manage your

accounts, transfer funds,

deposit checks, enroll in

e-statements, and more

ATMs & Branches

Find

one near you with our

Locations Tool.

Direct Deposit

Learn

how to set up direct deposit

– you’ll need

our routing number

(271992400) and your

14-digit Account (MICR)

number.

Digital Banking Tools

Download the Digital Banking app today!

Your Financial Well-being is Our Reason for Being

Life. Money. You.®

Life. Money. You.®

Take control of your money with Life.

Money.

You.®, a

personalized financial command center

offering tools and resources to help you

achieve your goals.

24/7

Access

24/7

Access

With Digital

Banking

services on

desktop or mobile and 30,000+ nationwide

ATMs, the Credit Union is there for you

whenever and wherever.

Putting

You First

Putting

You First

Not-for-profit and driven by a

member-first mentality, we’re committed

to your financial well-being – learn

more.

Lifelong

Membership

Lifelong

Membership

Once a Member, always a Member –

no matter where life takes you, the

benefits of Credit Union membership will

always be available to you and your

family.

What Are Your Goals?

Savings

Frequently Asked Questions

-

What's the difference between "Member Number" and "Account Number"?

- Member Number: A number assigned to your membership as a whole.

- Account (MICR) Number: A 14-digit number specific to the account type(s) you have (i.e. Checking)

-

How do I get answers for account-specific questions?

For the fastest, safest service, you can always rely on secure messaging. Log in to Digital Banking, select Message Center under “My Accounts” and then select Ask a Question.

-

How do I set up direct deposit?

To establish Direct Deposit to your Savings or Checking account, start by filling out your employer's Direct Deposit Form. ZTB provides several options to assist you. Login to Digital Banking and generate a customized direct deposit form.

-

How do I link my account to other financial institutions?

Transferring money between your Credit Union accounts and your accounts at other financial institutions is a piece of cake in Digital Banking. For more information on how to link your accounts, visit: #article/Setting-Up-an-External-Transfer-Account

-

When will I receive my Visa® ATM/Debit Card?

If you opened a Checking account, your debit card will arrive within 7 business days.

There are three ways to request a debit card:

- Visit a Service Center that issues debit cards to receive an instant issue debit card same day.

- In Digital Banking click on the share you would like to get a debit card for. In middle top right corner, you will see option to “Order a New Debit Card.” PS – If the share has had a debit card issued in the past for any member, they will not be able to order a Debit Card online.

- Contact Member Relations at +447307382143.

-

How do I set up online and mobile banking?

With the Mobile App, you have 24/7 access to the Credit Union. Save time by skipping the line – simply and securely view transactions, deposit checks, pay bills, open new accounts, and much more. It’s like having a Credit Union branch in the palm of your hand.

If you haven’t already, download the Mobile app today from the App Store℠ or Google Play™ store. For more information on how to set up online and mobile banking, visit: #article/RegisterforDigitalBankingAccess1

-

How do I apply for a loan?

For your convenience, you can apply for a ZTB loan a few different ways:

- Apply online through the BCU website or mobile website. Click on the Open an Account/Loan and select the type of loan you want to apply for. From there complete the loan application.

- Apply

via phone at

888-389-8344 (24 hours a

day, 7 days per

week)

- Apply in person at a Service Center

Please note:

- To apply for a loan, you must be at least 18 years of age (21 in Puerto Rico) unless legally married or emancipated.

- Loan approvals are valid for 90 days. After the 90-day approval period, the application will expire, and a new application will need to be submitted. A new credit check will also be required.

- Before we can fund a loan, your membership/accounts will need to be in good standing.